Transaction & Valuation

- Transaction & Valuation services

Transaction & Valuation services

Find our related services here

Go beyond tradition with our transaction advisory services

The world is ever-changing and increasingly more complex. Companies strive to be smart, innovative and forward thinking. Moore Hong Kong provides in-depth technical knowledge and extensive industry experience to keep you in control and aware of issues as they arise, as well as providing the expertise that goes beyond the traditional transaction advisory services.

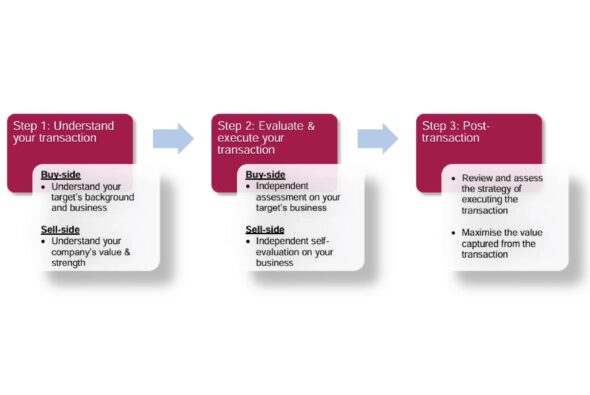

It takes steps to reach your goal. Whether your company is looking to raise development capital, make an acquisition, or undertake a joint venture, our Transaction & Valuation Services team ensures you a success. At Moore Hong Kong, we customise solutions from your perspective. From financial and tax due diligence through valuation, we work with you at every stage to maximise the value of every business transaction you undertake.

How can we support you?

Our Transaction Services team works closely with you to understand your needs and to develop bespoke solutions to complex issues. Our services in different stages include:

For more details, please refer to our brochure:

Due Diligence Does Matter

What is Due Diligence? Whether the form of investment is through equity, debt, or other arrangements, due diligence plays a crucial role in merger and acquisition (M&A) transactions before an investment decision is made or any agreement is being entered formally. This could be performed voluntarily or for compliance with statutory requirements or investment policies. This is important as the results of due diligence will identify risks and opportunities that will ultimately affect your negotiation position with the counterparty and the consideration to be paid.

Different types of due diligence serving different purposes exist. These include but not limited to financial due diligence, commercial due diligence, operational due diligence, tax due diligence, and vendor due diligence. The primary aim of due diligence is about investigation, audit or research to collect and confirm material facts of a target, or ensuring the acquirer has adequate financial strength to complete the transaction.

There are no one-size-fit-all due diligence solutions since investors have their own risk-return objectives and risk tolerance levels. At Moore, our due diligence specialists adopt a tailor-made approach on the procedures of hard due diligence and soft due diligence, from reviewing financial statements and historical financial performance, material contracts with customers and suppliers, related party transactions, market analysis, competitive landscape, future performance, cash flow projections, intangible assets, corporate tax and tax planning to corporate governance, management culture, human resources management, etc.

Our Moore Global network has a coverage of over 100 major cities around the world. As a closely connected network and with technologies such as online data room / virtual data room, we are able to provide you a one-stop, jurisdiction-specifc and language-barrier free solution, regardless of whether your transactions are domestic or cross-border(s).

Taking Valuation to Another Level

According to the Cambridge Dictionary, valuation is defined as “the act of deciding how much money something might be sold for or the amount of money decided on”.

Whether the valuation basis is “fair value”, “market value” or others, our valuation specialists take “valuation” to the next level by producing independent valuation reports that comply with valuation ethics and the valuation procedures and valuation report requirements stipulated by different professional associations and authorities to accommodate different business needs:

-

The International Valuation Standards (IVS)

Set out by the International Valuation Standards Committee (IVSC);

-

The RICS Valuation

Global Standards, aka the ‘Red Book’, set out by the Royal Institute of Chartered Surveyors (RICS);

-

The valuation requirements

Set out by the Hong Kong Stock Exchange (HKEx) in the relevant Listing Rules and Guidance;

-

The guidance on corporate transactions and valuations

Issued by the Securities & Futures Commission of Hong Kong (SFC)

-

The relevant valuation or assessment requirements

set out by the International Accounting Standard Boards (IASB) and the Hong Kong Institute of Chartered Public Accountants (HKICPA), such as:

IFRS 2 / HKFRS 2 – Share-based Payment

IFRS 3 / HKFRS 3 – Business Combination

IFRS 9 / HKFRS 9 – Financial Instruments

IFRS 13 / HKFRS 13 – Fair Value Measurement

IAS 2 / HKAS 2 – Inventories

IAS 32 / HKAS 32 – Financial Instruments: Presentation

IAS 36 / HKAS 36 – Impairment of Assets

IFRS 16 / HKFRS 16 – Lease

Due diligence is an indispensable and integral part of valuation.

Backed by our due diligence specialists, our professional valuers provide solid valuation support for purposes such as IPO, financial reporting, public documentation (e.g. listed companies’ announcements and circulars), merger & acquisition, and litigation (e.g. shareholders’ disputes, duxbury calculation and matrimonial proceedings).

The importance of corporate governance is gaining recognition by the public and authorities, at all time we work in tandem with auditors, financial advisers, banks and other consultants of our clients and endeavour to back up the decisions of acquisitions or disposals made by the board of directors, including independent non-executive directors (INEDs) and senior management to ensure full compliance with the relevant law and regulations and professional ethical standards.

We are experienced in performing business valuations and intangible asset valuations (e.g. trademark, patent, customer relationship) across a broad range of industry sectors, including but not limited to natural resources, information technology, biological assets, financial services, manufacturing, retail, and real estate properties. Different business enterprises have different needs, and we draw on our extensive sector knowledge to identify the correct approach to fit your needs.

Besides, our jobs also cover real estate and property valuations, and financial instruments related assessments, such as share options, convertible bonds, interest rate derivatives, swaps, call/put options, expected credit losses (ECL) and credit rating analysis. We always keep abreast of the latest valuation industry practices and studies and develop our valuation models and valuation tools accordingly.

Valuation Service

ASAPVal Business Ratings