HKFRS 16 Leases has become effective since 1 January 2019 and replaced HKAS 17 Leases for lease accounting to specify the principles for recognition, measurement presentation and disclosure of leases. The new standard specifies that individual leases should be considered separately, with the following exempted circumstances:

- Lease that have been fully prepaid

- Lease payments that are all variable

- Lease terms are short, i.e. less than 12-months

- Underlying assets are of low value

- Portfolio of lease assets with similar characteristics where the lessee reasonably expects that the results on financial statements would not be materially different

On the other hand, HKFRS 16 Leases does not apply to leases to explore for/ use of mineral, oil, natural gas and similar assets, biological assets, intellectual property licenses, service concession arrangement and rights under licensing agreements.

Essentially, most of the operating leases recognised in the past will be recognised as finance leases under the new standard and it requires lessees to record a “right-of-use” asset and a “lease liability” respectively. According to the standard, the lease liability is the present value of lease payments that are not paid at that commencement date that they

“shall be discounted using the interest rate implicit in the lease (IRIIL)

, if that rate can be readily determined. If that rate cannot be readily determined, the lessee shall use the lessee’s incremental borrowing rate (IBR)”.

Since the IRIIL is a lessor-specific rate which is determined by the lessor considering the lease payments, the fair value and the unguaranteed residual value of the underlying asset and the initial direct costs in entering the lease, for most of the case, it would be impractical for lessees to derive an IRIIL as lessor-specific information are commercially sensitive and unlikely available. It is foreseeable that IBR will be the more preferable choice when discounting lease payments for accounting purposes.

IBR is defined as “

the rate of interest that a lessee would have to pay to borrow over a similar term, and with a similar security, the funds necessary to obtain an asset of a similar value to the right‑of‑use asset in a similar economic environment”. In short, the standard requires a lessee of a lease to consider the followings when deriving an appropriate IBR:

- Financial creditworthiness & level of indebtedness of the lessee

- Currency of lease payments

- Economic environment

- Duration of the lease

- Nature and quality of the underlying asset

- The hypothetical amount “borrowed”

- Security provided by the lease

One should bear in mind that such an IBR is always derived on a case by case basis (except being exempted) and is typically lessee specific, asset-specific and lease-specific.

There are various interpretations on how an IBR could be derived. From a practical perspective, this could be as a straightforward two-steps approach:

Example

Example

Company A is a private company engaging in the management of retail stores in Hong Kong and has entered into a new 5-year lease for one of its stores. The annual cash payment in accordance with the lease agreement would be $10,000 in the first four years and $35,000 in the final year.

As quoted from a local bank, the 3-year unpledged lending rate for Company A is 6.35% and the 3-year pledged lending rate backed by the right-of-use of the store is 3.00% with a maximum loan-to-value (“LTV”) ratio of 60%.

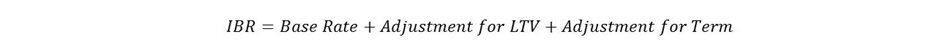

To derive the present value of the lease payment, management of the company (“Management”) adopted the 3-year pledged lending rate as the base rate and adjusted it for the hypothetical borrowed amount, i.e. LTV ratio and the duration of the lease to calculate the IBR for this lease respectively.

Adjustment for LTV

The 3-year pledged lending rate 3.00%, i.e. the base rate, has a maximum LTV ratio of 60% which is theoretically not sufficient to finance 100% of the lease. Therefore, Management derived an adjustment on the base rate assuming the lease would be financed partly by the pledged loan and partly by an unpledged loan according to the following formula:

The base rate is then adjusted upward by:

(6.35% - 3.00%) * (1 - 60%) = 1.34%

Adjustment for Term

As the term of the lease is 5 years and the term of the quoted lending rate is 3 years, Management considered an adjustment for term necessary. Historical statistics show that the 5-year benchmark lending rate in Hong Kong is generally 1.00% higher than that of the 3-year. Therefore, Management adopted a further 1.00% adjustment to the base rate.

Results

Based on the above, the resulting IBR was calculated as below:

The IBR for the lease in this case will be

3.00% + 1.34% + 1.00% = 5.34%.

The derivation of the present values of the lease payments is presented below:

| Cash flow of lease |

Year 1 |

Year 2 |

Year 3 |

Year 4 |

Year 5 |

Total Payment |

| Cash payment for lease |

$10,000 |

$10,000 |

$10,000 |

$10,000 |

$35,000 |

$75,000 |

| Discount factor at 5.34% p.a. |

0.9493 |

0.9012 |

0.8555 |

0.8121 |

0.7710 |

|

| PV of lease payment |

$9,493 |

$9,012 |

$8,555 |

$8,121 |

$26,984 |

$62,165 |

Please note the above example is hypothetical and has been simplified for illustrative purposes only. You are advised to consult your experts on relevant requirements and applications.

In Moore Transaction Services Limited, we have a team of financial analysts and accountants who are experienced in performing valuations for purposes such as M&A, financial reporting, listing and litigation purposes. For more details about how we could assist you in the relevant assessments, please contact our director

Kenneth Ma.